The Best Forex Trading Strategy

Want to jump directly to the respond? The all-time forex banker for nigh people is definitely FOREX.com or CedarFX.

Trading forex without a strategy is a fleck like starting out on a trip without a map since you never know where your account volition terminate up. You might make money or lose money, simply you lot have no thought which is more probable.

The big advantage of having a forex trading strategy is that you can take some of the guesswork out of trading currencies. Read on to find out more than most the best forex trading strategies and how to cull among them to merchandise currencies successfully.

Contents

- Picking a Forex Strategy

- All-time Forex Trading Strategies

- 1. Scalping

- ii. Day Trading

- iii. News Trading

- four. Swing or Momentum Trading

- 5. Trend Trading

- 1. Scalping

- Best Forex Brokers for Trading

- How to Get Started Trading Forex

- Oftentimes Asked Questions

Picking a Forex Strategy

Picking a forex strategy is one of the most important things you tin exercise to help assure your profitability every bit a currency trader, and then you will definitely want to choose a successful strategy.

You'll also want to select a strategy that best suits your lifestyle and personality type — not everyone wants to watch trading screens all 24-hour interval or is suited for the stress of fast-paced or high-risk strategies.

Once y'all've decided on one or more forex strategy options, you should check out how they perform. Kickoff, exam each strategy via backtesting, which can be done with the popular MetaTrader forex platforms if you have modest programming skills.

Vet your strategy in a demo account that virtually online brokers will permit yous to open without take a chance. If any strategies even so expect profitable, you can offset trading them in a live account for the ultimate test.

It's normally all-time to outset with smaller trades and then piece of work your way up to larger amounts as you gain confidence in the strategy'south performance and your ability to implement it in a disciplined way when trading alive.

All-time Forex Trading Strategies

Many successful strategies for trading forex be, simply not all of them are suitable for every trader. Select a strategy that all-time suits your particular state of affairs, including your available time, personality type and risk tolerance. These are covered beneath based on the typical time involved, ranging from short to long term.

i. Scalping

Scalping is a very short-term trading strategy that involves taking multiple pocket-sized profits on trading positions with a very short elapsing. Scalpers need ultra quick reaction times because they commonly enter and exit trades in but seconds or minutes. This very fast paced and a rather stressful activity that may not suit everyone.

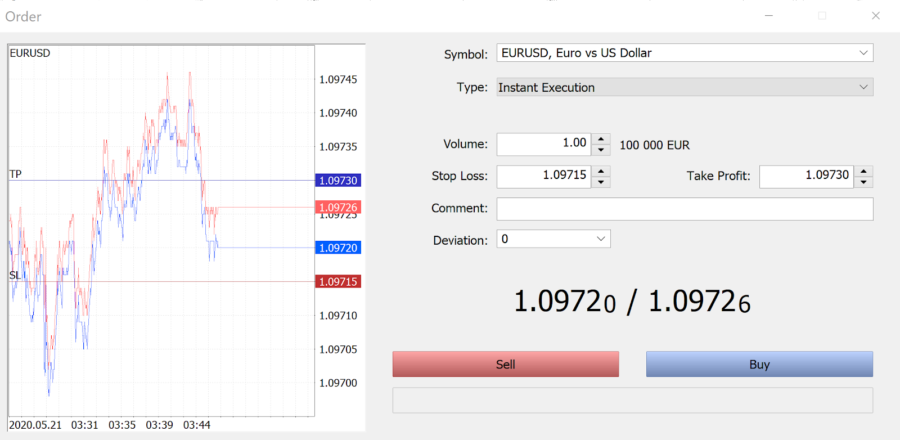

Scalpers also closely monitor price charts for patterns that can help them predict hereafter exchange rate movements. They tend to use very short-term tick charts like to that shown below for EUR/USD for analysis. Scalpers generally do best using a broker with tight spreads, quick guaranteed guild executions and minimal or 0 club slippage.

2. Day Trading

Solar day trading is some other curt-term trading strategy that is followed merely during a particular trading session. Day traders generally practise not have overnight positions, so they close out all trades each day. This helps reduce exposure to market movements when the trader is inattentive to the marketplace.

Most day traders use trading plans based on technical analysis on brusk-term charts that bear witness intraday price activeness. Many twenty-four hours trading strategies exist, just a popular one, is known as breakout trading. Trades get triggered when the exchange rate moves beyond a given level on the nautical chart for a currency pair and are confirmed when accompanied by an increase in book.

The thirty-minute candlestick chart of GBP/USD shows a breakout below the level of the lower of the 2 converging tendency lines of a triangle pattern fatigued in red. Notation that trading volume also increased when the breakout occurred, thereby confirming it.

iii. News Trading

Some forex traders with deep pockets and a decent appetite for risk might use news trading strategies, although they are probably not ideal for forex beginners. These strategies tin exist based on key and technical analysis and they generally benefit from the notable volatility often seen in the forex market immediately later on key news releases.

News traders typically demand to monitor economic calendars for key data releases. They and so lookout the marketplace closely before the issue to determine key support and resistance levels and then that they tin can react quickly afterward the event based on the results. News traders need to maintain strict discipline when managing their currency positions during such fast markets and ofttimes place finish-loss and accept profit orders in the market place.

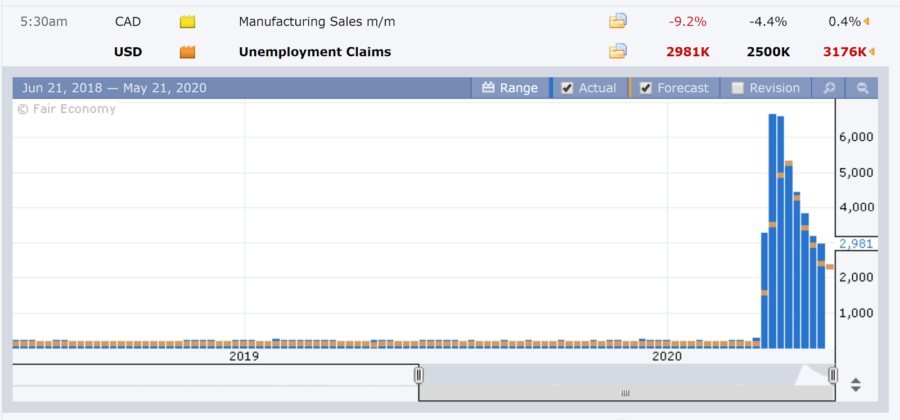

An example of an economic agenda and a data release result that a news trader might apply is U.Due south. unemployment claims. This data was especially volatile during the COVID-19 shutdown in the U.S. and created considerable fluctuations in the forex market after its release. Although those jobs numbers were dismal, what mattered nigh to the market is how the event differed from the market's consensus.

In the situation below, the previous unemployment claims number was 3,176K, the expected number was two,500K, and the result was worse than expected at 2,981K. This should have put pressure on the U.S. dollar subsequently its release versus other currencies.

four. Swing or Momentum Trading

Swing trading, sometimes also known as momentum trading, consists of a medium-term trading strategy that aims to capture more than market moves. Swing traders exercise this by trading both with major trends and besides against them when the market is correcting, then they should be willing to hold overnight positions.

Swing traders tend to focus on inbound and existing positions based on momentum indicators that provide purchase and sell signals. Traders utilize them to find overbought or oversold markets they can sell or buy. Swing traders might also buy ahead of support or sell earlier resistance levels that develop on the charts of the exchange rate for a currency pair.

Some commonly used momentum indicators include the Moving Boilerplate Convergence Difference (MACD) histogram and the relative force alphabetize (RSI). The daily candlestick chart shown beneath for the GBP/USD commutation rate besides displays the MACD and RSI in indicator boxes.

5. Trend Trading

Trend trading is a popular longer-term forex trading strategy that involves following the prevailing trend or directional movement in the marketplace for a particular currency pair. This strategy often involves buying on pullbacks in up trends or selling on rallies in downwards trends.

Afterwards a tendency trader has taken a position in the direction of the trend, yous volition probably hold onto it until the market place reaches their objective or the trend starts reversing. Tendency traders oftentimes use trailing stop loss orders to guard their profits if a significant reversal materializes.

Many tendency traders use technical analysis indicators like the Boilerplate Directional Movement Indicator (ADX) and/or moving averages that smooth out the price action so they can improve place trends. They might also use longer and shorter term moving averages and watch for crossovers to signal a potential reversal.

The 4-hr candlestick nautical chart for EUR/JPY below shows an upwards trend in progress after a significant decline with a 10-day moving average shown in red and the ADX in the indicator box underneath.

All-time Forex Brokers for Trading

If you want to outset trading forex right away or are looking for a better online broker to partner with, check out Benzinga'southward peak picks for forex brokers in the table beneath. You can beginning the account opening process today and most brokers will let y'all open a demo business relationship first to endeavour their services out and trade without whatever risk before depositing your coin. As an example of what to await for in a practiced forex broker, you lot can bank check out Benzinga'southward FOREX.com review.

How to Get Started Trading Forex

If you've chosen a strategy and a broker to use to trade forex, then remember that coin management and your trading mindset are key determinants of success. Accept time to brainwash yourself about those facets of trading forex, too.

When yous're ready to begin, visit the banker'due south website to open up upwardly a demo account then that you can start to practice trading and learn how to utilize its trading platform. If yous feel confident in your strategy and the broker you chose, then you can open and fund a live account to start trading with real money.

Frequently Asked Questions

How profitable is forex trading?

i

How profitable is forex trading?

asked

Luke Jacobi

1

How profitable you lot are with forex depends on yous! To make a turn a profit through forex trading, you must know how to trade intelligently and you too need a trading strategy. Trade with hazard capital merely — this is coin that y'all can afford to lose.

Ideally, forex trading shouldn't exceed more than 15% of your entire investment portfolio.

Answer Link

answered

Benzinga

What are the best forex trading tips?

i

What are the best forex trading tips?

asked

Luke Jacobi

1

Regardless of what marketplace you programme to trade, the online banker you choose is extremely important to your success. The broker you cull should exist well-regulated.

Put together a trading plan that lays out an appropriate position sizing method and articulate risk parameters. You can devise a trading program and exercise using it in a demo account. If y'all prefer to apply someone else's plan and re-create trades, then you lot volition demand to open an account with a broker that includes a social trading platform.

Learn from your mistakes, but don't let them push you over the edge.

Answer Link

answered

Benzinga

What are some forex trading strategies?

1

What are some forex trading strategies?

asked

Luke Jacobi

1

The most popular include scalping, day trading and position trading.

Answer Link

answered

Benzinga

What are some forex trading mistakes?

one

What are some forex trading mistakes?

asked

Luke Jacobi

ane

The most pregnant are the lack of sufficient majuscule and over-leveraging with margin.

Reply Link

answered

Benzinga

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets plus spot metals with low pricing and fast, quality execution on every merchandise.

Source: https://www.benzinga.com/money/best-forex-trading-strategies/

Posted by: shimpacconte.blogspot.com

0 Response to "The Best Forex Trading Strategy"

Post a Comment