How To Start Forex Trading In South Africa

What is Forex Trading?

Forex trading is the exchange of currencies to make a profit from fluctuations in the exchange rate. To open a trade, a trader must choose a currency pair, and the direction they look the exchange rate to motility. As the substitution charge per unit between the two currencies changes, the trader can shut the merchandise for a profit or a loss. More detailed information on how Forex trading works is hither.

Forex trading is ane type of Contract for Divergence (CFD) trading. This is a contract betwixt yous and your broker to pay any difference in the price of the currency pair betwixt opening and closing your trade. This means that neither you nor your banker needs to concord any currency.

Other CFDs that y'all tin can trade include commodities, cryptocurrencies, metals, equities, energies and many more. All Forex trading is CFD trading, simply not all CFD trading is Forex trading.

Is forex trading legal in S Africa?

Yes, Forex trading is legal in South Africa and regulated by the FSCA. All South African based brokers need to be regulated by the FSCA, but international brokers based overseas do not need such regulation. Individuals tin legally sign up with any Forex broker, based anywhere in the world, regardless of their regulatory status.

What is the difference between Forex trading and stock trading?

When people retrieve of trading, they often recollect of stock trading and believe Forex trading is almost the aforementioned thing. But this is incorrect.

Stock trading is the buying and selling of shares from individual companies. Forex trading is the simultaneous buying and selling of currencies to turn a profit from the change in the commutation rate. A couple of other major differences:

- The Forex market is a global, decentralised, over-the-counter exchange and all transactions and participants are confidential. Stock markets are based at a single location and public records are kept of buyers and sellers.

- Forex trading has a low cost of entry. To make serious profits, stock traders apply big amounts of money, which is not an selection for traders with limited incomes.

Forex trading isnot investing. Forex traders never take ownership of the asset beingness transacted. With Forex trading, the trader isspeculating on the future value of a currency pair and to call information technology an investment would exist incorrect.

Tin can I really become a forex trader in my home?

Yes, you demand some basic It equipment and you need to open an business relationship with a forex broker. You can teach yourself the basics of forex using the myriad of information bachelor on broker websites and the cyberspace more often than not or from lessons posted on the likes of youtube. It is wise to open a forex demo account where you tin do trading forex with virtual funds.

How practice I trade Forex in Due south Africa?

Forex trading is accessible to everyone with an internet connexion. But merely because everyone can practise it, does not mean that everyone should practice it. Serious Forex traders know that education, discipline, and strategy are essential elements of a profitable trading career. If you commencement trading Forex without these skills, you may turn a profit from a few trades, just y'all will eventually lose.

If you set up properly and you are set to learn, Forex trading can be a groovy mode to create a steady income. But, before nosotros look at the more circuitous aspects of trading, let us await at the essential things you are going to demand:

A fast and stable internet connection

The Forex markets move fast, very fast, and if your connexion is ho-hum or drops out you are going to lose money. Winning trades can get losing trades in the glimmer of an eye. Many South Africans trade on their mobile phones, but this should be used as a backup (or to check on open trades when on the movement) and not as a primary trading platform.

A Forex broker

Finding a good Forex broker is of the utmost importance. We maintain an updated list of the best Forex brokers in South Africa and a complete Forex broker directory that includes all brokers including those we practice not trust or recommend, for educational purposes just. If you have heard of a broker and desire to know if y'all can trust them, the directory is a good identify to commencement. TradeForexSA only recommends the all-time Forex brokers in South Africa, reviewed using a transparent review process.

A Forex Trading Platform

This is the software that y'all are going to utilise for trading and will be provided by your Forex broker. Some brokers have their ain platforms, simply almost back up third-party apps like MetaTrader 4, MetaTrader five and cTrader. The best Forex trading platform is the 1 that y'all observe the almost comfortable to use. Many brokers will offer more than one blazon of platform, so a demo account to check out the different platforms at different brokers.

A Demo Account

Beginners should learn to trade using a demo account, earlier depositing money into a real trading account, and then you acquire how the market works and trading platform works without losing any of your own coin. They are also a more comfortable way to endeavor out dissimilar strategies or trade unlike currencies without taking any risk.

Nosotros take a Forex trading in South Africa beginners guide to go you started, and more than on how to place your starting time trade. Information technology will accept some time to larn how to trade Forex successfully, as traders need to understand the many components and strategies to be profitable.

What do I demand to open an account with a forex broker?

The process varies from i broker to another but generally involves filling in an online form and providing some form of ID such as a passport, driver's licence, etc., and a utility nib. You may also have to respond to an email or text message to verify your details. You should be able to open an business relationship online but if this is not possible you may take to ship proof of identity in the post. You volition besides be required to deposit money into the business relationship before y'all can begin trading.

How much do I need to start trading Forex in South Africa?

Trading accounts tin be opened for every bit little as v USD (lxx ZAR), though most brokers require a minimum deposit between 100 USD and 200 USD. But how much should yous starting time trading with? The respond depends on how much you tin can afford and how much risk you are willing to take.

Beginner traders should first with a minimum account balance between 200 – 500 USD. This allows traders to make small profits, while nonetheless maintaining a sensible arroyo to adventure.

Which currencies pairs tin I merchandise?

You can trade in a vast number of permutations of freely floating currencies. Many traders cull to focus on ane or ii major currency pairs so they build a skillful level of expertise and knowledge of those currencies, their trading patterns and successful strategies. Examples of major currency pairs include the pound and the dollar, the euro and the dollar or the dollar and the yen. These are called majors because they business relationship for the bulk of trading. Because demand for and the supply of these currencies is so vast it is easy to buy and sell positions.

What is the best time for trading Forex?

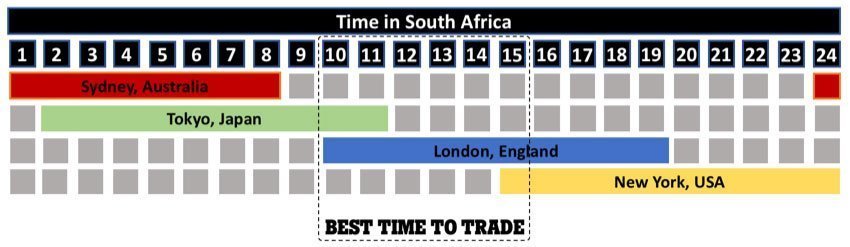

The Forex market is open 24 hours a twenty-four hour period, Monday-Friday, simply the best fourth dimension to trade Forex is when the globe's major stock markets are nigh active. The more traders are active in the market place, the more volatile the market is – and the more than volatile the market is, the easier it is to make profits.

The two cities with the largest financial markets in the world are New York and London, so the best time for Due south Africans to trade Forex is the crossover period when both the London and New York financial markets are open.

The ii other major markets are the Sydney market and the Tokyo market and trading when these markets are open is besides a adept approach, though you will have to stay up very late, or get upwards very early on.

For more than detail on the best times for trading and how daylight savings fourth dimension affects the major markets, read our piece on the best times for trading Forex in South Africa.

What is the all-time strategy for Forex trading?

There is no single strategy that guarantees success. Profitable traders will use many strategies and they will know exactly when to apply each one. Forex trading strategies volition rely on either central assay (analysing economical trends and news events) or technical analysis (analysing historical cost activeness on charts). It is also wise to practice the strategy without using existent money until you are sure you know how information technology works and how to implement it.

The most popular trading strategies are:

Price Action Trading: This is the written report of historical changes in currency prices to predict which way the cost is going to motility next. If you beloved studying charts and looking for patterns, then price action trading is for y'all. It relies near entirely on technical analysis and there are many methods of trading using price action.

Range Trading: Range trading relies on figuring out at what point other traders are going to buy or sell a currency. Like price action trading, range trading relies on technical analysis just too needs a skillful agreement of the currency pair you are trading.

Scalping: Scalping is when a trader opens and closes many trades over the class of a 24-hour interval. The goal is to make lots of small profits. Technical assay is an of import factor with scalping, just the main problem is the fourth dimension investment required. Scalpers can spend the whole 24-hour interval glued to their trading monitor.

Positional Trading: Positional trading is when a trader holds a position, or several positions, over a long period of time – sometimes for weeks or months or even years. Positional trading is heavily reliant on fundamental analysis, though technical analysis can exist important too.

Other factors to consider when planning a Forex strategy are the time of solar day (as this affects how many other people are trading and the volatility of the market), order types (such as terminate loss and take turn a profit orders) and automated trading software/bots (which tin can see movements in the market that you may miss).

For more detail on analysis and how to use information technology, we cover strategies and building a trading plan in our Forex trading for beginners section.

What are the risks of trading Forex?

Trading Forex and CFDs carry a meaning adventure that includes losing all the money in your trading account over a short flow. 75-ninety% of traders lose money trading these products. You should consider whether you lot understand how CFDs piece of work and whether you tin afford the loftier hazard of losing your money.

The principal risks of Forex trading are:

Risk 1 – Volatility: The Forex market is extremely volatile at times. Information technology is, after all, because of this volatility that we tin turn a profit from trades. But the market place can move very swiftly, and this tin can mean a trade can go against you in a curt period. If you are trading, you must actively lookout man your trades all the time.

Take a chance 2 – Unpredictability: The Forex market is not something you lot can predict. There are just as well many factors and actors on the market place for it to be fully predictable. Traders need to set a win-loss target ratio where y'all account for some losses and use a strategy to minimise them.

Risk 3 – Leverage: Profiting from CFD trading requires using leverage. Leverage is a tool used in trading to amplify your profits, only information technology besides amplifies your losses which are automatically deducted from your trading account. Your account balance tin be wiped out with a single bad trade.

Risk 4 – Interest: In some cases, involvement volition exist charged on your trades. For example, interest can exist charged when you carry trades overnight and your banker will take funds from your account to pay this fee.

Can I limit my potential losses?

The trading platforms offered past forex brokers offer loss limitation features. It is common, for example, to prepare a loss limit amounting to 2% of the total funds you have in your account on whatsoever trade. You can fix upwards the loss limit you are prepared to accept before you lot enter into any trade.

For example, If you accept a starting balance of 10,000 ZAR, this ways that you should never risk more than 200 ZAR on a trade. Many beginner traders cannot beget to start with a remainder of 10,000 ZAR, but if y'all start with an account of 100 ZAR be aware that it is going to take patience and solid take a chance management to create a steady income stream.

Do Forex traders have to pay tax on my profits?

Yes, you will have to declare whatsoever profits y'all make while trading and may have to pay capital gains revenue enhancement on them if you are a private investor. If you are a self-employed trader, you will be liable for whatever tax on the profits. For more on this read our taxation commodity.

Tin I lose more than I hold in my account?

That is incommunicable with a banker regulated past the FCA, ASIC or CySEC, who will just close your account when it gets close to zero. This is called negative remainder protection, and while offered by almost brokers in South Africa, information technology is not required by the FSCA to be offered to all clients and not always activated past default.

Is Forex Trading Correct For Me?

By at present you should know that information technology is a high run a risk, that y'all need to discover a broker that you lot feel suits y'all best and the amount you want to put into your business relationship with a broker. Trading Forex takes a commitment to learning, and you should be ready to:

- Compare the best brokers in South Africa to observe one that suits yous.

- Read our Forex trading for beginners section and acquire everything you can.

- Understand the way the Forex market and CFD trading works.

- Learn about the software and tools that will power your trading.

- Be prepared to lose all the money you identify in an business relationship. Do non eolith any money y'all cannot afford to lose.

Source: https://tradeforexsa.co.za/

Posted by: shimpacconte.blogspot.com

0 Response to "How To Start Forex Trading In South Africa"

Post a Comment