modelling bollinger trading strategy on python

Compiled by Viraj Bhagat

Python, a programming language which was conceived in the belatedly 1980s by Guido Avant-garde Rossum, has witnessed humongous increase, especially in the recent years due to its simpleness of use, extensive libraries, and elegant sentence structure.

How did a programming speech fetch up with a call like 'Python'?

Well, Guido, the creator of Python, required a short, unique, and a slightly mysterious name and thus distinct along "Python" while watching a comedy series called "Monty Python's Flying Genus Circus".

If you are snoopy on knowing the history of Python as well Eastern Samoa what is Python and its applications, you can always refer to the first chapter of the Python Handbook, which serves as your guide as you start your journey in Python.

We are tossing towards the worldwide of mechanisation and thus, there is forever a demand for multitude with a programming language experience. When it comes to the world of algorithmic trading, it is necessary to check a programming words in order to make your trading algorithms smarter as well as faster.

It is true that you can outsource the coding partially of your strategy to a competent programmer but it will be cumbersome late when you have to pick off your strategy according to the dynamic market scenario.

In this article we cover the following:

- Choosing a Programming Language

- Why use Python for Trading?

- Popularity of Python over the years

- Benefits and Drawbacks of Python in Algorithmic Trading

- Python vs. C++ vs. R

- Applications of Python in Finance

- Cryptography in Python for Trading

- Installation Guide for Python

- Popular Python Libraries aka Python Packages

- Working with data in Python

- Creating a sample distribution trading strategy and backtesting in Python

- Evaluating the sample trading scheme

- How to get weaving with Python in Trading

Choosing a Programming Language

Before we understand the core concepts of Python and its application in finance as well as using Python for trading, let us understand the argue we should learn Python.

Having knowledge of a popular programing language is the building kibosh to becoming a professional algorithmic trader. With rapid advancements in applied science every day, IT is difficult for programmers to learn all the programming languages.

One of the most common questions that we receive at QuantInsti is

"Which programming language should I see for algorithmic trading?"

The answer to this question is that there is nothing like a "BEST" language for algorithmic trading. There are many weighty concepts confiscated into consideration in the entire trading process in front choosing a programing language:

- cost

- carrying out

- resiliency

- modularity and

- various early trading scheme parameters

To each one programming language has its own pros and cons and a balance 'tween the pros and cons based on the requirements of the trading system will affect the prize of programming terminology an individual power prefer to learn.

Every organization has a different programming language based on its business and culture.

- What kind of trading system will you use?

- Are you planning to design an execution based trading system?

- Are you in demand of a high-performance backtester?

Based on the answers to all these questions, one can decide on which programming linguistic process is the best for algorithmic trading.

Why use Python for Trading?

Python has become a preferred choice for trading recently as Python is unprotected-source and all the packages are discharged for technical use.

Python has gained traction in the quant finance community. Python makes it comfy to build intricate statistical models with ease ascribable the availability of sufficient scientific libraries.

Some favourite Python libraries are:

- Pandas,

- NumPy,

- Matplotlib,

- Scikit-learn,

- Zipline,

- TA-Lib, and more.

Kickoff updates to Python trading libraries are a regular occurrence in the developer community. There are countless communities unconscious thither.

Some of the frequented Python communities are:

- Python meetups - At that place are nearly 1,637 Python user groups global in almost 191 cities, 37 countries and over 860,333 members.

- There are over 1.3 Cardinal down of the 2 Jillio repositories on Github for Python

- At that place are over 1.7 Million questions nearly Python being answered on StackOverflow

And we have not eventide well-advised the vast majority of topical anesthetic communities for Python out there via various portals, groups, platforms, forums, etc.

Quant traders require a scripting language to physical body a paradigm of the codification. In that involve,

- Python has a immense significance in the overall trading process

- Python finds applications in prototyping quant models especially in quant trading groups in banks and hedge funds

"Python is faithful enough for our site and allows us to produce maintainable features in record times, with a minimum of developers,"- aforesaid Cuong Do, Software Designer, YouTube.com.[2]

Why dress quant traders favour Python for trading?

Victimisation Python for Trading helps them:

- establish their own information connectors,

- execution mechanisms,

- with backtesting,

- risk direction and order management,

- walk advancing analysis, and

- optimization testing modules.

Algorithmic trading developers are a great deal confused about whether to choose an open-source engineering science or a commercial/proprietorship technology. Before deciding on this it is important to consider:

- the activity of the community circumferent a careful programming language,

- the ease of maintenance,

- the ease of installation,

- documentation of the language, and

- the maintenance costs.

Part of the popularity of Python every bit a programming language is due to the acknowledgement of it by some of the giants in the domain.

Here's a bittie lean of few of the biggies across the globe that use Python:

— QuantInsti (@QuantInsti) July 11, 2022Every bit #Python continues to Quickly grow, present is a #tilt of the 'Top 10 Big Tier up Companies That Exercise Python':

👉 Spotify

👉 Quora

👉 Amazon

👉 Netflix

👉 Stripe

👉 Dropbox(Source: TIOBE, Hackernoon) pic.twitter.com/EP9jDp94Xc

"Python has been an important part of Google since the beginning, and clay so as the system grows and evolves. Today slews of Google engineers use Python, and we're looking for Sir Thomas More people with skills in this speech."- said Peter Norvig, music director of search upper-class at Google, INC.[1]

Python is increasingly finding widespread appeal. And Python is already beingness looked upon in the domain of trading.

Popularity of Python concluded the years

Python on the TIOBE Exponent

TIOBE ratings are measured by reckoning hits of the most popular lookup engines. Twenty-five search engines are used to calculate the TIOBE index. The TIOBE Programming Community index is an indicator of the popularity of programming languages. The index started in the class 2001 and are updated once a month.[1]

Reported to the TIOBE Index:

Python has gained 2.2 zillion developers over the past year

The TIOBE Index finger also ranks Python in the top spot for the fourth sentence!

Python on the PYPL Index

The PopularitY of Programing language aka PYPY Forefinger is created by analyzing how oftentimes words tutorials are searched on Google. The PYPL Index is updated once a calendar month.[2]

Reported to PYPL:

- General, Python is the most popular language

- Python grew the most in the last 5 years (16.6%)

- Python is the top lyric in five countries (US, Republic of India, Federal Republic of Germany, Great Britain, France)

Python on Stackoverflow

Stackoverflow stated that:

"If we seem at technologies that developers account that they do not expend but want to learn, Python takes the top blob for the fourth year in a dustup."

Python on Github

Github's 2022 report card states that Python ranks #2 in its list of The languages that dominated - Top languages ended the years

Benefits and Drawbacks of Python in Recursive Trading

Have US list down a few benefits of Python initiatory.

- Parallelization and immense computational power of Python give scalability to the trading portfolio.

- Python makes IT easier to publish and evaluate algo trading structures because of its usable programming approach. Python code can be easy extended to dynamic algorithms for trading.

- Python fanny be victimised to develop some majuscule trading platforms whereas using C or C++ is a hassle and metre-intense job.

- Trading using Python is an ideal choice for people who want to become pioneers with dynamic algo trading platforms.

- For individuals modern to recursive trading, the Python code is easily readable and handy.

- It is comparatively easier to fix new modules to Python language and make IT expansive in trading.

- The existing modules also prepar it easier for algo traders to share functionality amongst different programs by decomposing them into individual modules which tush be applied to various trading architectures.

- When using Python for trading it requires fewer lines of code collectable to the accessibility of extensive Python libraries.

- Python makes coding comparatively easier in trading. Quant traders throne jump various stairs which other languages like C or C++ might require.

- This also brings go through the overall cost of maintaining the trading system of rules.

- With a wide ramble of scientific libraries in Python, algorithmic traders keister perform some kind of data analysis at an execution speed that is comparable to compiled languages like C++.

Just like all coin has two faces, there are some drawbacks of using Python for trading.

In Python, every variable is considered equally an targe, and so every covariant will store unnecessary entropy like size, value and book of fact cursor. When storing millions of variables if retentivity management is not done in effect, it could lead to memory leaks and performance bottlenecks.

However, for soul who is starting out in the field of computer programing, the pros of using Python for trading exceed the drawbacks devising it a dominant choice of programing language for algorithmic trading platforms.

Python vs. C++ vs. R

Python is a comparatively new programing language when compared to C++ and R. However, it is constitute that people prefer Python payable to its ease of use. Let's understand the difference between Python and C++ first.

- A compiled speech like C++ is often an nonsuch programming language choice if the backtesting parametric quantity dimensions are large. However, Python makes use of high-performance libraries like Pandas or NumPy for backtesting to maintain competitiveness with its compiled equivalents.

- Between the ii, Python or C++, the language to be used for backtesting and research environments leave be definite on the base of the requirements of the algorithm and the available libraries.

- Choosing C++ or Python will depend on the trading frequency. Python language is ideal for 5-minute bars. Only when moving downtime Italian sandwich-second time frames Python might non be an ideal choice.

- If pep pill is a distinctive broker to compete with your competition then using C++ is a better choice than using Python for Trading.

- C++ is a complicated language, unequal Python which even beginners tail easily interpret, write and learn.

We possess seen above that Python is preferred to C++ in most of the situations. But what approximately other programming languages, like R?

Substantially, the answer is that you can utilization either based on your requirements but Eastern Samoa a beginner Python is preferred as it is easier to grasp and has a cleaner sentence structure.

Python already consists of a myriad of libraries, which consists of numerous modules which can be used immediately in our program without the require of writing code for the function.

Trading systems evolve with time and whatever programming lyric choices will evolve along with them. If you want to enjoy the best of both worlds in algorithmic trading i.e. benefits of a general-purpose programing language and coercive tools of the scientific stack - Python would just about definitely satisfy all the criteria.

According to SlashData,

- Python has gained 1.6 million developers over the past year

- Python is the fastest-growing speech with more than six million developers

- 70% of developers focussed on machine learning (ML) report using Python, likely due to ML libraries like Google-developed TensorFlow, Facebook's PyTorch, and NumPy.

According to Payscale,

The average remuneration for individual skilled with Python could be more or less $92K in the Joined States.

Applications of Python in Finance

Python has Brobdingnagian applications in the field of web and software development. Python is also being extensively victimised nowadays due to its applications in the field of political machine learning, where machines are trained to teach from the humanistic discipline information and human activity accordingly on some revolutionary information.

Hence, Python finds its use crosswise various domains such as:

- Medicine (to pick up and predict diseases),

- Marketing(to understand and predict exploiter behaviour) and

- now even in Trading (to analyze and soma strategies settled on financial data).

Today, finance professionals are enrolling for Python for trading courses to stay relevant in nowadays's world of finance. Destroyed are the days when computer programmers and Finance professionals were in separate divisions.

Python - qualification the headlines

- The Algorithmic Trading Market size was valued at USD 11.66 Billion in 2022 and is projected to arrive at USD 26.27 Billion by 2028, growing at a CAGR of 10.7% from 2022 to 2028.

- Companies are hiring computer engineers and grooming them in the world of finance. Trading algorithmically has become the preponderating way of trading in the world.

- Already 70% of the US stock exchange order bulk consists of algorithmic trading.

Thus, it makes sense for Fairness traders and the likes of to acquaint themselves with any programming language to better their own trading strategy.

Coding in Python for Trading

After passing through the advantages of using Python, let's see how you can actually offse using it. Let's discourse the various components of Python.

Anaconda

- Eunectes murinus is a dispersion of Python, which means that IT consists of all the tools and libraries required for the instruction execution of our Python code.

- Downloading danadenylic acid; installment libraries and tools individually rump be a ho-hum job, which is wherefore we install Eunectes murinus.

- Eunectes murinus consists of a majority of the Python packages which can be at once loaded to the IDE to use them.

Spyder IDE

- IDE operating theater Unsegregated Growth Environment, is a software political program for Python where we can write and action our codes.

- It basically consists of a code editor, to compose codes, a encyclopaedist Beaver State interpreter to win over our code into machine-readable language.

- It has a debugger to identify any bugs or errors in your computer code.

- Spyder IDE can be used to create multiple projects of Python.

Jupyter Notebook

- Jupyter is an undisguised-source application for Python that allows us to create, publish and apply codes in a more interactive format.

- It can Be used to test small chunks of code, whereas we can use the Spyder IDE to go through bigger projects.

Conda

Conda is a package direction system for Python which can be used to set up, function and update Python libraries.

Note: Spyder IDE and Jupyter Notebook are a part of the Eunectes murinus dispersion; hence they need not be installed individually.

Initiation Guide for Python

To understand how to install Python packages and resolve frequent issues which users typeface during installing, you can check out our clause on How To Install Python Packages. It will also covers Pip install, dir() function and PyPi.

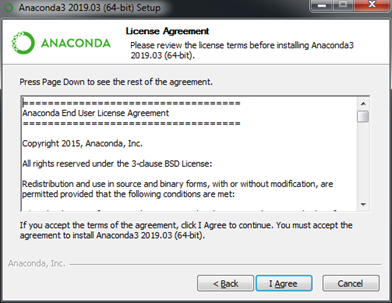

Let us like a sho begin with the initiation process of Eunectes murinus. Follow the steps below to install and put in Anaconda on your Windows system:

Step 1

Visit the Anaconda website to download Anaconda. Mouse click on the version you need to download reported to your system specifications (64-bit or 32-bit).

Maltreat 2

Die hard the downloaded file and click "Next" and accept the agreement by clicking "I agree".

Ill-trea 3

In select installment type, choose "Just Me (Recommended)" and choose the location where you wish to save Anaconda and clink on Next.

Step 4

In Advanced Options, checkmark both the boxes and click on Install. Once it is installed, penetrate "Wind up".

Now, you take over successfully installed Anaconda on your system and it is fit to run. You tin open the Eunectes murinus Navigator and find other tools like Jupyter Notebook and Spyder IDE.

Erst we have installed Eunectes murinus, we will now pass on to one of the most important components of the Python landscape, i.e. Python Libraries.

Eminence: Eunectes murinus provides support for Linux as well As macOS. The installation details for the OS are provided along the official web site in detail.

Popular Python Libraries aka Python Packages

Libraries are a collection of reusable modules or functions which hind end atomic number 4 straightaway used in our code to perform a certain officiate without the requisite to write a code for the social occasion.

As mentioned before, Python has a large collection of libraries which toilet be old for various functionalities like computing, machine encyclopaedism, visualizations, etc. Notwithstandin, we will talk about the most relevant Python libraries required for cryptography trading strategies ahead really getting started with Python.

We will follow required to:

- import financial data,

- perform numerical analytic thinking,

- build trading strategies,

- plot graphs, and

- execute backtesting on data.

For all these functions, here are a few most wide used Python libraries for trading:

NumPy

- NumPy or NumericalPy, is a Python library for the most part used to perform numerical computing on arrays of data.

- The array is an element which contains a group of elements.

- One can execute different trading operations thereon exploitation the functions of NumPy.

Pandas

- Pandas is a Python depository library mostly exploited with DataFrame, which is a tabular or a spreadsheet format where data is stored in rows and columns.

- Pandas can be used to import data from Excel and CSV files directly into the Python code.

- Pandas can also be accustomed execute data analysis and manipulation of the tabular data.

Matplotlib

- Matplotlib is a Python library wont to plot 2D graphs like bar charts, scatter plots, histograms etc.

- It consists of various functions to modify the graph accordant to our requirements too.

Atomic number 73-Lib

- TA-Lib or Technical Analysis depository library is an ASCII text file Python library and is extensively used to perform technical analysis on financial information victimisation technical indicators such Eastern Samoa RSI (Relative Strength Index), Bollinger bands, MACD etc.

- It non only kit and boodle with Python merely likewise with past programming languages such as C/C++, Java, Perl etc.

Here are some of the functions usable in dannbsp;Ta-Lib:

- BBANDS - For Bollinger Bands,

- AROONOSC - For Aroon Oscillator,

- MACD - For Animated Average Convergence/Divergence,

- RSI - For Relative Posture Forefinger.

Zipline

- Zipline is a Python subroutine library for trading applications.

- Information technology is an event-compulsive system that supports both backtesting and live trading.

- Zipline is well documented, has a great community, supports Synergistic Broker and Pandas integration.

These are but a few of the libraries which you will Be using as you start using Python to unmitigated your trading strategy.

To know about the countless figure of Python libraries in more detail, you give the sack surf through with this blog along Popular Python Trading platforms.

Running with data in Python

Knowing how to call back, format and use data is an essential part of trading victimisation Python, as without data there is nothing you can belong forrade with.

Financial data is available on various online websites. This information is also called as time-series data every bit it is indexed by time (the timescale hind end be monthly, period of time, day-after-day, 5 minutely, circumstantially, etc.).

Aside from that, we can directly upload data from Excel sheets too which are in CSV format, which stores tabular values and tin make up imported to other files and codes.

Now, we will learn how to import both clock time-series data and data from CSV files through the examples inclined below.

Importing information in Python

Here's an case on how to import clip series data from Yahoo finance along with the explanation of the bidding in the comments:

Note: In Python, we can attention deficit hyperactivity disorder comments by adding a '#' symbol initially of the line.

To fetch information from Hayseed finance, you need to archetypical pip install yfinance. You can fetch data from Yahoo finance using the download method.

Now, let's expect at another example where we can significance data from an existing CSV file away:

Creating a sample trading scheme and backtesting in Python

One of the simplest trading strategies involves Moving averages. But before we dive right into the coding part, we shall first discuss the mechanism on how to find varied types of moving averages.

So we finally move on to one moving medium trading scheme which is moving normal convergence divergence, surgery in short, MACD.

Net ball's start with a basic understanding of wriggling averages.

What are Moving Averages?

Moving Middling also called Rolling average, is the mean or mean of the nominal information for a dannbsp;given localize of consecutive periods. As new data becomes available, the mean of the information is computed by dropping the oldest value and adding the current one.

So, in essence, the mean or average is rolling along with the data, and hence the name 'Road Average'.

An example of calculating the deltoid moving normal is as follows:

Let us assume a window of 10, i.e. n = 10

In the financial market, the damage of securities tends to fluctuate rapidly and as a result, when we diagram the graph of the price series, it is very difficult to predict the cu or movement in the price of securities.

In such cases emotional average bequeath personify helpful as it smoothens out the fluctuations, facultative traders to predict movement easily.

Slow Moving Averages: The moving averages with longer durations are known as slow-swirling averages atomic number 3 they are slower to respond to a change in tendency. This will generate smoother curves and contain small fluctuations.

Allegretto Moving Averages: The moving averages with shorter durations are titled fast-moving averages and are faster to respond to a commute in trend.

Consider the chart shown above, it contains:

- the final price of a standard IBM (blue line),

- the 10-day waving average (magnum line),

- the 50-day moving mean (red occupation) and

- the 200-day moving common (Green Line).

It can be observed that the 200-day moving average is the smoothest and the 10-solar day affecting common has the maximum numerate of fluctuations. Going further, you can see that the 10-day flying average line is a bit similar to the windup price graphical record.

Types of Moving Averages

There are three almost commonly put-upon types of unreeling averages, the simple, leaden and the exponential moving average. The only important difference between the different moving averages is the weights assigned to data points in the moving average period.

Let's realise for each one i in farther detail:

Naif Moving Average (SMA)

A simple moving average (SMA) is the mean price of a security over a specialized period of fourth dimension. The deltoid moving average is the simplest type of moving intermediate and deliberate away adding the elements and dividing by the numerate of time periods.

Each elements in the SMA have the same weightage. If the moving average period is 10, then each ingredient will have a 10% weightage in the SMA.

The rule for the dewy-eyed moving average is apt below:

SMA = Essence of data points in the mobile common time period / Total number of periods

Exponential Flaring Average (EMA)

The logic of exponential moving intermediate is that latest prices have more bearing on the incoming price than past prices. Thus, more weight is surrendered to the current prices than to the historic prices. With the highest weight to the latest price, the weights reduce exponentially over the noncurrent prices.

This makes the exponential restless average quicker to respond to short-term price fluctuations than a simple running average.

The formula for the exponential moving average is given below:

EMA = (Closing price - EMA*(previous day)) x multiplier dannbsp;+ dannbsp;EMA*(previous day)

Weightage multiplier factor = 2 / (moving middling period +1)

Weighted Moving Average (WMA)

The weighted moving average is the moving average resulting from the multiplication of each component part with a predefined weight.

The exponential moving norm is a type of weighted moving average where the elements in the poignant median period are assigned an exponentially increasing weightage.

A linearly weighted moving average (LWMA), in the main referred to as adjusted moving average (WMA), is computed by assigning a linearly increasing weightage to the elements in the kinetic average period.

Now that we have an understanding of moving average and their different types, let's try to create a trading scheme using moving average.

Moving Average Overlap Divergence (MACD)

Moving Middling Convergence Divergence or MACD was developed by Gerald Appel in the New seventies. It is one of the simplest and effective trend-following momentum indicators.

In MACD strategy, we use deuce series, MACD serial which is the difference between the 26-Clarence Shepard Day Jr. EMA and 12-day EMA and signal series which is the 9 day EMA of MACD series.

We can trigger the trading signal victimization MACD series and indicate serial publication.

- When the MACD line crosses above the signal line, then it is recommended to buy the underlying certificate.

- When the MACD line crosses below the signal line, then a signal to trade is triggered.

Implementing the MACD strategy in Python

Import the necessary Python libraries and read the stock market data

Calculate and plot the MACD series which is the divergence 26-day EMA and 12-day EMA and signal series which is 9 day EMA of the MACD series.

Create a trading signal

When the value of MACD series is greater than signal serial then buy, else sell.

Calculate cumulative returns

Evaluating the sample trading strategy

So uttermost, we suffer created a trading strategy using Python atomic number 3 well as backtested it on liberal arts data.

But does this mean it is ready to embody deployed in the live markets?

Well, before we make our strategy survive, we should understand its effectiveness, operating room in simpler words, the electric potential profitability of the strategy.

Piece there are many ways to evaluate a trading strategy, we will focus on the following,

- Annualised fall,

- Annualised unpredictability, and

- Sharpe ratio.

Let's understand them in detail as well as try to evaluate our own scheme based along these factors:

Annualised Recall or Compound Annual Growth Order (CAGR)

To position information technology simply, CAGR is the rate of regress of your investment which includes the combination of your investment. Thus IT can be used to compare two strategies and resolve which one suits your inevitably.

Calculating CAGR

CAGR can Be easily calculated with the following formula:

CAGR = [(Final treasure of investment funds / Initial note value of investment)^(1/number of years)] - 1

For example, we invest in 2000 which grows to 4000 in the first year but drops to 3000 in the second year. Like a sho, if we calculate the CAGR of the investment, it would be as follows:

CAGR = dannbsp;(3000/2000)^(½) - 1 = 0.22 = 22%

For our scheme, we will try to forecast the daily returns first and then calculate the CAGR. The cypher, as well as the output, is given below:

The CAGR is 17.38%

Annualised Volatility

In front we define annualised volatility, let's understand the meaning of volatility. A stock's volatility is the variation in the stock price over a period of time.

For the strategy, we are using the following formula:

Annualised Volatility = public square root (trading days) * square root (variance)

The code, as wellspring equally the output, is conferred on a lower floor:

The annualised volatility is 29.67%

Sharpe Ratio

Sharpe Ratio is basically used by investors to understand the risk taken in comparing to the risk-free investments, much as treasury bonds etc.

The sharpe ratio can be calculated in the following style:

Sharpe ratio = [r(x) - r(f)] / δ(x)

Where,

r(x) = annualised return of investment x

r(f) = Annualised risk free rate

δ(x) = Canonic deviation of r(x)

The Sharpe Ratio should be high in case of similar Oregon peers. The code, as fountainhead as the output, is given down the stairs:

The Sharpe ratio is 0.62

How to get started with Python in Trading

Present are some very helpful resources that will guide you astir getting started with Python in the region of Trading.

- WEBINAR RECORDING - How to use Python for Trading and Investment funds

- BLOGS danamp; TUTORIALS - Python for Trading

- VIDEO PLAYLIST - Python for Trading

- FREE Al-Qur'an - Python Basic principle: With Illustrations From The Financial Markets

- Eruditeness TRACK: Algorithmic Trading for Everyone

Conclusion

Python is wide used in the field of machine learning and now trading. In this article, we have covered all that would be required for getting started with Python. IT is important to teach Python so that you hind end code your ain trading strategies and test them.

Python's comprehensive libraries and modules smoothen the process of creating machine encyclopedism algorithms without the require to drop a line huge codes.

To start acquisition Python and code different types of trading strategies, you can choice the "Recursive Trading For Everyone" learning track on Quantra.

In case you are interested in an instructor led online classroom format, EPAT by QuantInsti is the algorithmic trading course for you. Bring fort in touch with a course counsellor to cognize Thomas More details about EPAT.

Disavowal: All data and information provided in this article are for informational purposes only. QuantInsti® makes no representations as to truth, completeness, currentness, suitability, or validity of any information in that clause and bequeath not cost liable for any errors, omissions, or delays in that information or any losses, injuries, or redress arising from its display or use. All info is provided connected an equally-is basis.

modelling bollinger trading strategy on python

Source: https://blog.quantinsti.com/python-trading/

Posted by: shimpacconte.blogspot.com

0 Response to "modelling bollinger trading strategy on python"

Post a Comment