Trading 50% Retracements with Price Action Confirmation - shimpacconte

This is one of the most powerful cost action trading strategies you will ever read, information technology's one of my favorite patterns. You need to pick up this, and apply it.

This is one of the most powerful cost action trading strategies you will ever read, information technology's one of my favorite patterns. You need to pick up this, and apply it.

Enjoy the lesson…

In this price action trading lesson, I am expiration to explain how to use the 50% Fibonacci retrace in conjunction with a damage action reversal 'confirmation' signal, ideally a pin bar setup or fakey bar reversal setup.

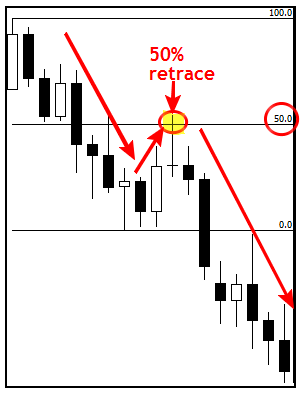

IT is a widely accepted fact among chart technicians that most major moves, and many minor ones, will eventually retrace to around the 50% level of the move. There are many reasons why these 50% retracements are then prevalent in the market, simply we aren't going to ruminat on those today, because in the end it doesn't really matter, what matters is that the 50% retrace is a very real and very useful event to be aware in the marketplace.

I am only a fan of trading the 50% trace forth a swing low operating room high as long as at that place is a price action signal to confirm its cogency; meaning, I get into't "blindly" enter only because the market has retraced to a 50% plane. My trading is all around confluence and finding prove to support the price signals on the charts.

How to find the 50% spirit level of a move

Ahead we talk about trading price action signals from 50% retrace levels, we need to be clear on how exactly to draw in the 50% levels because I know from some of the emails that come out connected the livelihood line that some traders don't really understand how to properly get out use the Fibonacci drawing tool on their Meta Trader 4 trading political program.

Quick note: I don't use all the other Fibonacci extension levels because there are just to a fault many of them and I don't check the point of having so many a different levels all over your charts. The 50% phenomenon has been proved across hundreds of long time of technical analysis whilst the other Fib levels are much much haphazard and mortal-fulfilling in the sense that if you put enough lines all all over your charts, some of them are going to get hit regardless of whether or not there is any significance behind them or non. I primarily only utilisation the 50% pull dow, just for me it is an 'approximate' 50% retrace and that means if a valid signal forms near the 50% level, say anywhere from a 45% retrace to a 60% reconstruct, I will also enumeration that as a sensible retrace and treat it the corresponding I would Eastern Samoa a signal exactly at the 50% level.

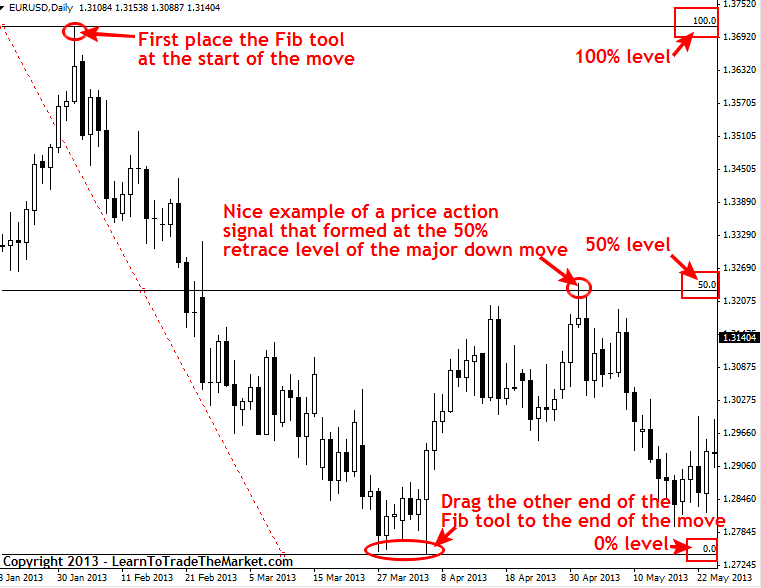

Information technology really is quite simple to draw in the 50% levels, but it's important that you sympathise where a move begins and where it ends, because I know some traders get confused about that. Where the move started should atomic number 4 an exact high or low of the move, or very close to it, this is where you first place the Fib tool, then you click and drag the other end of the Taradiddle tool to the other end of the motivate; where the go off terminated. Where the move started you should see the "100.0" in the top suited of the Fib tool and you should see the "0.0" in the bottom outside of the Fib instrument. This might seem puzzling at get-go to have the 100 % level at first of the move, but it makes perfect sense if you flirt with it like this: You are look for a retracement of a move, so by the fourth dimension the move is finished and the commercialise starts retracing, IT is aflare back toward the blood line of the move and if it were to retrace back down or mastered all in all move, it would then have retraced 100% of the move. See the chart below for more aid:

In the case below, we are looking how to right apply the Fibonacci tool to find the 50% retrace level of a Major down pull in the EURUSD pair:

How to trade price action signals from 50% reconstruct levels

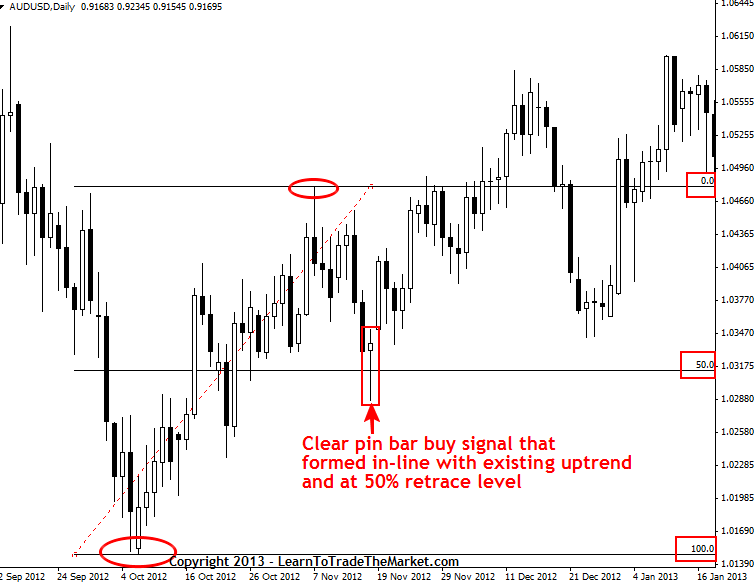

When you have a cost action signal present on the daily chart, you then match improving the fib 50% retracement level if there is same present (see graph case at a lower place), if the price action candle holder signal matches up with the 50% swing retracement level then you'Re cracking to function and potentially have a valid trade. If you can also find a pertinent horizontal rase to match over here, its a 'double curse' of merging (a reason to get excited).

The process of trading the 50% reconstruct is simple, below is peerless example of a Recent trade on the AUDUSD pair:

After finding the potential sell signal, decide to enter at market prices, or wait for a pull in reply to get your stop loss tighter to reduce overall risk. In the chart example above, minded the 'perfection' of the setup, as prices started to move upwardly in the correct direction, a pole-handled entry could get been taken, impulse in the true direction is forever a good sign.

These obvious and 'perfect' price action setups at a 50% retrace level can lead to huge moves on each day chart fourth dimension frames and learnedness how to identify and craft them nates consecrate you a very potent trading tool for your price execute trading toolbox.

I in person feel that when a bargainer looks for the toll action signal first, then matches up the supporting factors (merging) they tend to make better trades. What I am saying here is this…if you see a giant signal connected the daily chart, find knocked out what other factors are backing it up and showing supportive tell apart; we South Korean won't always be able to trade a signal, mainly because we prefer not to fight the natural trend of the market, and many times we see signals forming against the trend.

In the next chart example to a lower place, the 50% swing construct line and price carry through signal both came together at one common point and showed America a nice setup here, but what you should really take away from this example is that IT was in line with the general force of the market, notice that preceding to the draw back, we adage a nice taunt improving, and the pull back did not exceed the 50% area , preferably it rejected it strongly and has now bounced sharply higher to the new recent highs.

In this example we can see a 50% retrace in the EURJPY and a price action buy sign that formed showing rejection of it:

I hope this article clears some confusion approximately Fibonacci levels. Personally, I only mother a handful of these setups monthly along the daily charts, but when you see these swing retracements inside a national trend movement, its sapiential to mark them on your charts and past look for a Mary Leontyne Pric action confirmation entry signal. These setups typically lead to just about very significant, and potentially very profitable moves, for more information on trading price action at law signals from 50% retracements levels, checkout my price action course and members area.

Source: https://www.learntotradethemarket.com/forex-trading-strategies/trading-50-percent-retracements-price-action

Posted by: shimpacconte.blogspot.com

0 Response to "Trading 50% Retracements with Price Action Confirmation - shimpacconte"

Post a Comment